These employees handle escalation and generally help to improve the service or a product relying on customer’s requests and complaints. Second tier support consultant’s knowledge base is usually broader and more advanced than that of the L1. Their responsibilities might include testing, researching and digging deeper. Consultants of the first tier are solving the simplest and most common clients’ issues.

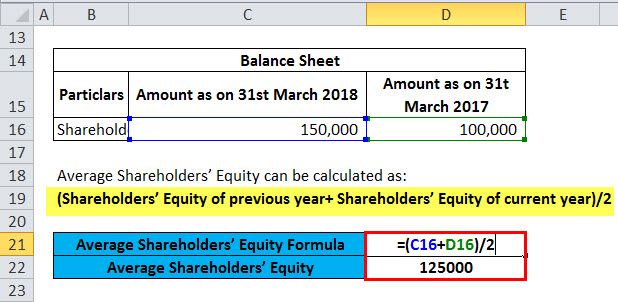

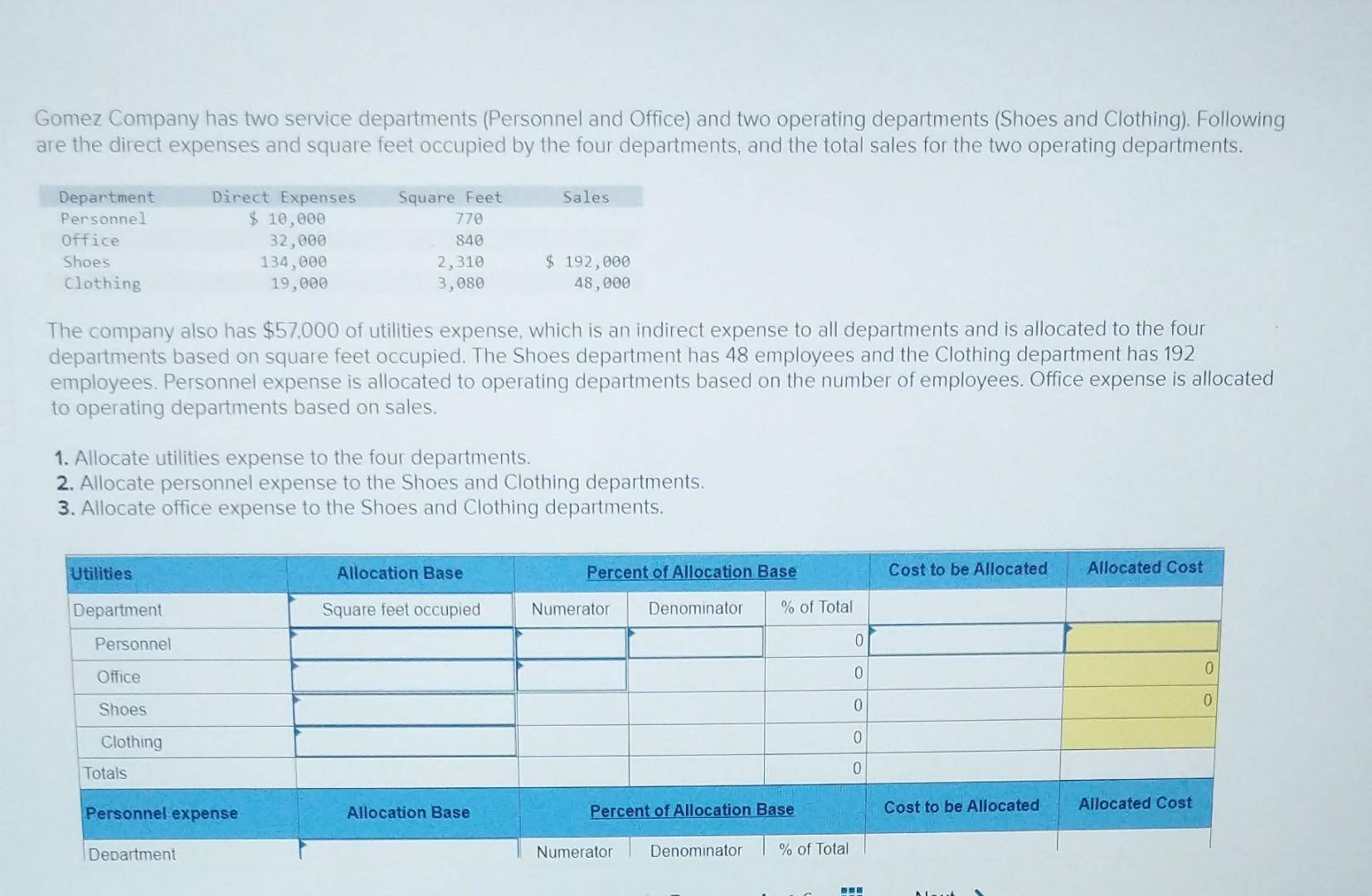

1: Allocation of Service Department Costs

With the right tools and expertise, mobile services can become part of your strategy for reaching a wider audience and growing your car dealership’s client base. There are many moving pieces, and they all have to be working in unison, or else your car sales will suffer. Train your team to remain calm, actively listen to customer concerns, and provide fair resolutions. Adopt a problem-solving approach and focus on retaining customer satisfaction even in challenging situations. By turning unhappy customers into satisfied ones, you can rebuild trust and strengthen customer relationships. When customers have positive experiences with a service department, they are more likely to share their experiences with friends, family, and colleagues.

Sell cars on the lot faster with AutoRaptor

- Too often management underestimates the importance of relationships between the employees.

- Whether that means standardizing your billing or expanding the number of payment options you accept, your team and your customers will thank you.

- It’s important to keep in mind that there are many different ways to set and measure profit goals, so finding the right ones for your business can be a challenge.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

But a great service department can be so much more than that—it can be a gateway to customer loyalty and repeat business. It can be a place where customers feel like they’re being taken care of by people who really care about them and their needs. Gain a deep understanding of your target customers’ expectations by conducting surveys, analyzing customer feedback, and tracking customer satisfaction metrics.

b. Know what your customers’ needs are and how you can meet those needs

Examples of service departments are maintenance, administration, cafeterias, laundries, and receiving. Service departments aid multiple production departments at the same time, and accountants must allocate and account for all of these costs. It is crucial that these service department costs be allocated to the operating departments so that the costs of conducting business in the operating departments are clearly and accurately reflected. In conclusion, running a successful service department requires attention to various key areas.

Key Responsibilities of a Service Department

If you notice a trend of negative feedback, it might be time to retrain your team, focusing on enhancing the customer service experience. Customer service representatives possess extensive knowledge of the company’s offerings, rules, and procedures. However, in a rapidly evolving business landscape, merely understanding these aspects isn’t enough.

Client Relationship Manager

If you’re looking to optimize your service department, there are plenty of tools that can help you keep a tight control of costs, especially labor costs at your dealership. One of the best ways to identify where you’re doing well is by using market share benchmarks. These benchmarks help you understand how much business other dealerships in your area are getting compared to yours. For example, if your dealership is getting twice as many sales as other dealerships in the area, then it’s likely that your marketing efforts are paying off. When a customer reaches out to a service department, it is essential to provide a swift response.

Additionally, explore chatbots and artificial intelligence solutions to handle routine inquiries and provide quick responses to customers, freeing up time for your team to handle more complex issues. When the companies’ managers choose bases to use, they consider such criteria as the types of services provided, the benefits received, foreclosure and the fairness of the allocation method. Examples of bases used to allocate service department costs are number of employees, machine-hours, direct labor-hours, square footage, and electricity usage. For a company to thrive, it’s crucial that all its departments operate at maximum efficiency – and customer service is no exception.

Establish clear roles and responsibilities, set realistic targets, and monitor performance regularly. Leverage automation tools and software to streamline administrative tasks and enable employees to focus on providing excellent customer service. In today’s competitive landscape, customer experience is a key differentiator.