ROCE measures the profitability and efficiency of a company’s operations and is a valuable tool for evaluating its financial performance. When interpreting ROCE, investors should consider various factors and analyze it in conjunction with other financial metrics and industry benchmarks. Firstly, investors should compare the company’s ROCE with its historical performance and competitors’ average ROCE to determine the relative performance. If the company’s ROCE has been consistently higher than its historical average and industry average, it indicates that the company has been consistently profitable and efficient in utilizing its equity capital. Secondly, investors should analyze the trend of ROCE over time to determine whether it is increasing, decreasing, or fluctuating.

Limitations of ROE

ROCE is a critical financial ratio that measures a company’s profitability and efficiency in utilizing its equity capital. Investors should also consider the limitations of ROCE and avoid common mistakes while using it as a performance indicator. expense recognition principle ROCE may witness new trends and developments, such as the impact of ESG factors and customized benchmarks, in the future. Therefore, investors should stay updated and adopt a comprehensive approach to analyze ROCE effectively.

ROE and Growth Metrics across the Same Industry

Net income is calculated as the difference between net revenue and all expenses including interest and taxes. It is the most conservative measurement for a company to analyze as it deducts more expenses than other profitability measurements such as gross income or operating income. These financial ratios form the basis of fundamental research, which is key to finding high-quality dividend stocks that could be the backbone of your retirement.

Return on Common Stockholders Equity Calculator

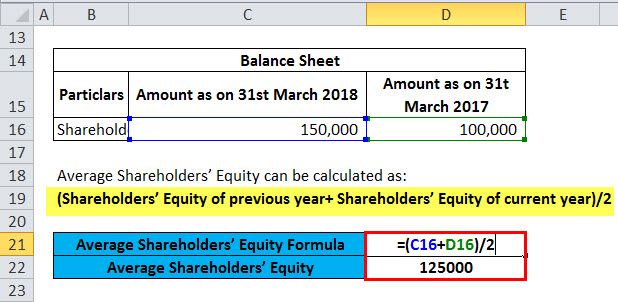

Thirdly, ROCE is a forward-looking financial metric that helps analysts and investors predict future profitability based on past performance. To calculate ROE, divide the company’s net income by its average shareholders’ equity. Because shareholders’ equity is equal to assets minus liabilities, ROE is essentially a measure of the return generated on the net assets of the company.

- This can be a particular concern for fast-expanding growth companies, like many startups.

- ROCE is a financial metric that calculates the return generated by a company on its common equity, which is the shareholders’ equity less preferred dividends.

- The best value of ROE is roughly several dozen percent, but such a level is difficult to reach and then maintain.

- For such an endeavor, we can use the debt-to-capital ratio, which relates the interest-bearing debt to the shareholder’s equity (see debt to capital ratio calculator).

- Generally, investors have greater confidence in companies with a high and sustainable ROCE than in growth-oriented companies that cannot sustain growing returns on common equity.

Though ROE looks at how much profit a company can generate relative to shareholders’ equity, return on invested capital (ROIC) takes that calculation a couple of steps further. Finally, negative net income and negative shareholders’ equity can create an artificially high ROE. However, if a company has a net loss or negative shareholders’ equity, ROE should not be calculated. Each year’s losses are recorded on the balance sheet in the equity portion as a “retained loss.” These losses are a negative value and reduce shareholders’ equity.

What Is a Good ROE?

In summary, return on common shareholders’ equity ratio is a useful metric that can be used to measure a company’s profitability and historical financial performance. A higher return on common equity ratio indicates that a company is generating higher profits from the net assets that have been invested by shareholders. Company C’s high ROCE indicates that it is efficiently utilizing its equity capital and generating a high return on investment. However, investors should consider the sustainability of this high ROCE and the impact of industry and economic factors on future performance. Investors may also analyze the trend of ROCE over the years and the impact of the company’s growth strategies on profitability. By comparing a public company’s net earnings to its shareholders’ equity stakes, ROE helps you understand how efficiently a firm is using its investors’ money to generate profits.

This guide has aimed to demystify the nuances of calculating and interpreting ROCE, laying a foundation for insightful financial analysis. For instance, comparing the ROCE of a tech start-up with that of a manufacturing giant could lead to misleading conclusions. Acknowledging these sector-specific nuances is crucial for a fair and insightful analysis.

Net profit margin is a crucial indicator of a company’s efficiency in converting sales into profits. A high net profit margin increases ROE because the company generates more net income from each dollar of revenue. Net profit margin considers all expenses, taxes, and interest, and the resulting net profits significantly influence the equity holders’ returns. Since equity is equal to assets minus liabilities, increasing liabilities (e.g., taking on more debt financing) is one way to artificially boost ROE without necessarily increasing profitability. This can be amplified if that debt is used to engage in share buybacks, effectively reducing the amount of equity available.

For a thorough analysis, comparing a company’s ROE against its industry average provides a clearer picture of relative performance. Calculating the Return on Common Stockholders’ Equity (ROE) allows investors to gauge how efficiently a company employs its equity capital to generate profit. Analysts can use the ROE formula as a performance metric by scrutinizing the balance sheet and income statement.

This distinction is crucial for accurately assessing how efficiently a company’s core equity is being put to work, free from the influence of debt and preferential claims. ROE varies across sectors, especially as companies have different operating margins and financing structures. In addition, larger companies with greater efficiency may not be comparable to younger firms. A return on equity that widely changes from one period to the next may also be an indicator of inconsistent use of accounting methods. First, they identify a great business and then start looking at the share price to determine if it’s a good deal. It’s worth noting that investing comes with its share of risks, and you should always do your research, seek professional advice, and stay up-to-date with the latest market trends and news.